-

-

Meruzhan Danielyan

12:18 | 08.06.15 | Articles | exclusive 7178

How to find an investor? Tips for Armenian startups

Creating a startup is initially an enterprise of a bunch of dreamers. Everything starts getting serious when startup owners seek people who are ready to invest money in it. The world is now overflowed with products and the majority of them do not find an investor after all.

How not to be among losers? What steps will help you find a right investor and from which investor can you eventually get money?

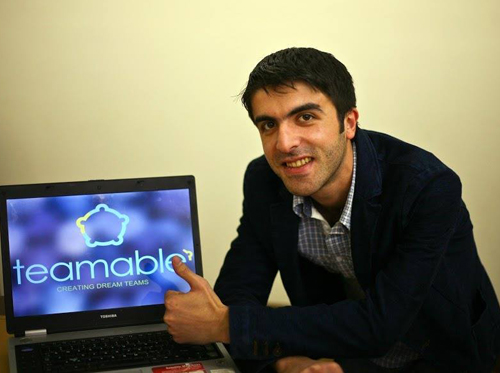

Teamable startup created by Armenian developers is one of the successful startups in Armenia that managed to stretch out and expand outside of Armenia. The software solutions offered by the company are used in around 20 American companies.

Together with one of co-founders of Teamable, Meruzhan Danielyan, Itel.am tried to find the answers to the above-mentioned questions.

1. Have an initial product and business vision

If you want to get an investment you should clearly show that your team is able to do what it wants. The minimum product created by your team is the vivid example. It should prove interesting to a particular target group. You should be confident that what you do is not merely an idea- it has a business future. It’s critical to figure out your target group you’ll be working for, why they should buy your product and what they will get while using your product.

2. Take money from an investor only when it’s really needed

Move forward with your own funds as long as it’s possible. You should only take the sum when you see your resources are not enough for moving forward. You will need new people and money to market your product, etc. If you’re sitting in your room and developing a product and your resources are sufficient for it, you shouldn’t just take money. Money that you get from outside is responsibility: don’t think that’s it. The later you get the money, the better. The more developed your product, the easier to find an investment given the fact that the needs of a startup are shaped in this phase.

3. Use all the opportunities to meet an investor tête-à-tête

Connecting with an investor on a social network is not serious. Investors are busy and they don’t idle around waiting for you to write to them. The best option is to meet investors during special events. For instance, you can just “run into” an investor in a non-formal environment, during a coffee-break, and get acquainted with him. Eye contact is very important in startup-investor relations. The first tête-à-tête meeting is also important because he wants to know the team and not only invest money in a project.

4. Find a right investor

One of the most common errors that startups make is that they don’t pay attention to who gives them the money. Of course, it’s very hard to refuse money from a person who is willing to invest in your startup. However, first of all, you should understand who the investor is. You should take “smart money”.

It’s desirable that the investor be informed about the field your startup operates in. It’s also desirable for him to have some contacts and experience in the field. The investor is not only the one who gives money- he’s also a consultant and mentor, he should have connections useful for the business development. Only at that time, can you expect a double result.

When the money is invested, you should use the investment in a right way. Once in 2-3 months you should inform them about your progress. Offer the investor to help you promote your product and set a network. Mutual trust is very important as after the investment he becomes your teammate.

Narine Daneghyan

17:29 | 24.09.25 | Articles

Jacopo Losso on Cross-Border Investments and Why Armenia Attracts Angels